DISCLOSURE: This is not financial advice. I own stock in one or more of the companies mentioned here. Please conduct your own diligence and consult someone who is a financial advisor before making any investment decisions. This is not intended to be used as a recommendation to buy or sell any securities.

Remitly (RELY US) | Mkt Cap: $4.25bn | ADV: $75m | Price Target: $38 / 74% upside

Executive Summary

Remitly is a digital-first cross-border remittance (C2C) provider. A very strong 2H ’24 highlights the earnings-inflection thesis and assuages bear fears that the business does not scale. I see a topline growth CAGR ~25% over the next few years while margins expand significantly.

Thesis

Significant opportunity for op. leverage with mid-term EBITDA margins >20%

Taking market share from brick-and-mortar incumbents due to superior offering

Equity looks undervalued vs peers and I see ~75% upside over the next 18mo

Attractive reward/risk ratio at 2.4x; bull case upside of 135% return

Business Overview

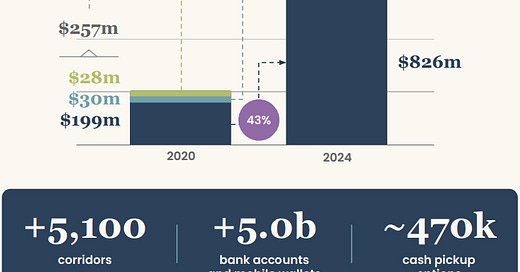

Remitly is an international payments provider focused on cross-border remittances. Customers typically engage with the company via their mobile app or online, sending money to international recipients who can access the funds via bank transfer, credit/debit cards, or cash pick-up. Remitly supports sending money from 30 countries to more than 170 receive countries, which equates to more than 5,100 corridors (unique pay in / pay out pairs).

The business records revenue via transaction fees (take rate) and a on a small margin between the FX mid-market rate. Remitly earns a 66% gross margin (up from 58% in 2021) after paying fees to disbursement partners / payment processors and accounting for fraud prevention. Remitly has strong relationships with local banks in over 170 countries, resulting in a disbursement network of over 5.0bn potential bank accounts / mobile wallets and 470,000 cash pick-up locations. In lower-income economies where cash is king, physical pick-up locations (such as a Walmart or Oxxo convenience store in Mexico) are critical for less tech-savy recipients that depend on cash receipts to fund rent, groceries, or medical expenses. Remitly is extremely focused on customer experience—after all customers must absolutely trust their remittance provider to execute transactions effectively. In fact, >90% of transactions are disbursed in less than an hour and Remitly’s app boasts a 4.9/5 rating across 1.8m reviews.

The business is growing exceptionally well as of Q4 2024, with active customers up 32% to 7.8m, revenue up 33%, an Adj. EBITDA margin of 13% in 2H. The business was also GAAP profitable (a surprise) in Q3 ‘24. On the back of these strong results, management provided solid 2025 guidance of 24-25% revenue growth and $180 - $200m of Adj. EBITDA (2% to 13% above street ests.) or just 12-13% margin vs 13% in 2H ‘24. I view these numbers as conservative and supportive of a beat / raise story over the next several quarters. If incremental margins are anything like the 28% recorded in 2024, EBITDA margins should be >14% and a large beat vs the street. In many ways, Remitly looks like an open-ended growth story reaching a critical inflection point through scale and operating leverage.

Industry Overview

Estimates of the international remittance market peg total send volume at ~$1.8tn per year (FXC Intelligence). The remittance market generally has good tailwinds: an increasingly globalized economy, growing migrant incomes, consumer preference for digital, and geopolitical flare ups leading to more immigration. According to the World Bank, banks are the most common channel for sending remittances (average cost: 12.1%) while mobile operators are the cheapest (average cost: 4.1%). Take rates have generally been on the decline over the past 15 years—for example the cost of sending $200 to East Asia and the Pacific in 2010 was ~10% vs ~5.9% in 2023. Take-rate compression can largely be explained by customers switching away from banks to low-cost digital operators such as Remitly (average take rate of 2.32%) as well as incumbent fee compression. As seen directly below, C2C is a small portion of the gigantic Wholesale, B2B and consumer payments ecosystem.

The overall non-bank market is fragment with the market share leader in remittance, Western Union, processing ~5.8% of overall send volume vs RELY’s ~3%. Other large competitors include Wise (WISE LN), MoneyGram (private), Xoom (owned by Paypal), Revolt (private). RELY, Xoom, and WU (only in 12 countries) are the only digital providers offering cash pick-up options, while Wise supports ~40 currencies and is focused on larger cross-border transfers, especially in B2B. Over the past 3 years, Remitly has grown send volume at a 40% CAGR while WU has limped along at a 4% send volume CAGR. See directly below for a comparison of send volume and take-rate. The question then becomes, how many customers does this business need to reach true scale advantages? I am reminded of a Charlie Munger example on scale and informational advantages – in his case for chewing gum brands.

“If I go to some remote place, I may see Wrigley chewing gum alongside Glotz's chewing gum. Well, I know that Wrigley is a satisfactory product whereas I don't know anything about Glotz's. So if one is 40 cents and the other is 30 cents, am I going to take something I don't know and put it in my mouth which is a pretty personal place, after all, for a lousy dime?” – Poor Charlie’s Almanack

Remitly seems to be inflecting towards Wrigley-level awareness with 7.8m customers, who suggest the platform to friends and family. Word of mouth, oft mentioned by mgmt., obviously scales with users (and is free!). Altogether, the RELY flywheel is working and RELY is well-positioned to be a low-cost winner in this market over the next 5 years (see Appendix A for market share projections).

Fundamental bet & Projections

Fundamental bet: market share taker with a considerable mid-range beat and raise opportunity. Remitly is going from a growth at all costs >30% grower to a more reasonable GARP name growing >20% and growing margins. Management likes to talk about LTV / CAC >6x and payback periods <12mo—I calculate gross LTV / CAC at ~7x & a payback period of ~10mo, for what it’s worth. These are attractive unit economics and top of mind as marketing spend (~22.5% of sales) is a major cost center and growth driver. In Q3 2024, we saw EBITDA margins beat at ~14% as the business added 459k customers fueling 35% customer growth while marketing spend increased just 24%…Q4 was much of the same with marketing spend growth of 11% vs revenue less transaction expenses (basically gross profit) grew 33%.

This leads me to the inevitable question, what are medium-term margins? The bid-ask based on my conversations seems to be in the 20 to 30% EBITDA margin range. This is obviously dependent on deployed marketing dollars…it is easy to play with the numbers and take the business down to ~5% growth resulting in ~28% EBITDA margins in 2027. However, I would reason and suspect that the company sees a substantial growth opportunity ahead and won’t throttle marketing spend down so quickly just to prove there is margin in the business.

My estimates (directly above) suppose that RELY grows ~28% in ’25 (24-25% guide) and 27% in 2026. Simultaneously, EBITDA margins increase ~4% in ’25 & ’26 as there is some fixed cost leverage (tech and data + G&A spend) while marketing spend grows at ~20% each year. This should result in ~$236m / ~$385m of EBITDA in ’25 / ’26, which is 21% / 42% higher than consensus. If these numbers (I view them as reasonable and likely) are close to correct, then we should see significant estimate revisions along with a re-rating.

Valuation & Price Target

I lay out a current cap table (below) along with my target valuation at YE ‘26 (at right, below). I value Remitly at 13.3x ‘27 Adj. EBITDA. This compares to WISE’s core business at 14x ’27 EBITDA (I value Wise banking in SOTP). It also look to broader payment comps growing in the teens, which trade at 13x ‘27 EBITDA. From an absolute valuation perspective, I see rationale for valuing a capital-light reoccurring payments business at mid-teens EV / EBITDA for mid-teens growth, meaning my target valuation based on comps would be conservative. My ~$38 PT also corresponds to a ~23x forward Adj. EPS on 2026 #s; again I view this as reasonable for the growth profile and potential of the business.

Contemplating a downside case: low 20s% growth in 2025 with growth thereafter declining, EBITDA margins of 10% / 12.5% in ’25 / ’26 (reminder, margins in Q3 were ~14%). I could see RELY trade alongside lower-growth payment peers around 10-11x EV / ’26 EBITDA. This would correspond to a share price of ~$16 or ~29% downside. I view this as a disappointing outcome but nonetheless an unlikely one. The main in vogue bear-case revolves around crypto rendering the entire 175 yr old remittance space obsolete. Although worth monitoring (especially around potential loosening of U.S. regulations), I would contend that the receive countries (Philippines, South Africa, Venezuela, etc.) where RELY users send money are cash economies. Unless crypto exchanges go on successful a multi-geography teaching and marketing blitz, I am dubious that crypto will be used overnight by generations that are just now learning how to download apps on their phones.

A Bull case would underwrite sustained mid-20s growth and EBITDA margins of 20% by 2026, resulting in nearly $400m of EBITDA. At these levels and for a rule of ~45 business, Remitly could trade at 25x 2026 EV / EBITDA or ~$52 and ~135% upside. Although also unlikely (in that timeframe) given how growth (via marketing dollars) and margins interact here, the business does show signs of durable growth and margins are just starting to really ramp.

To Sum it Up

I view Remitly as a compelling investment with strong upside over the next 18-24mo. This is a rare situation as the equity is trading at ~2.0x 2026 revenue (an implied 8x EV / EBITDA at 25% margin maturity)—this is an attractive level for a mid-20s grower, with >65% gross margins, a reoccurring revenue base featuring low churn, and strong FCF conversion close to 100%. By end of this decade, I wouldn’t be surprised if Remitly commanded 5% of the global market-share from a current ~3%; on 1-2bps of gross take rate compression every year (which consumers will love) and 25-30% EBITDA margins, I would expect >$1bn of EBITDA in 2030 vs a current EV of $4bn. This makes for a very compelling medium-term compounder story entry at current prices.

Appendix A: LT Market Size and Earnings potential