Deeply undervalued, negative EV net-net; growing and producing FCF

Abandoned net-net with 75%-100% upside and limited downside

Quick deep value idea for bargain seekers looking to hide out in assets trading below net cash amid the market volatility and geopolitical uncertainty.

CRON US | $722m mkt cap | ($70m) Enterprise Value | ADTV: $3m USD

Situation Overview

True net-net with $70m of negative EV

Tons of investor fatigue because they have destroyed value but now it's Ben Graham cheap

Leader in the cannabis gummy market in Canada (maybe 20% market share in the Spinach brand alone)

Growing (revenue +28% in Q1), profitable (7% EBITDA margin) turnaround story

Gross margins are expanding (Q1 ’25 to 44% from 18%) as they restructure

Huge cash balance and FCF positive in 2024 (unusual for net-nets!)

~$840m of cash vs ~$720m mkt cap

Altria owns 40% of the company & could acquire the business at >100% premium and pay next to “nothing” for their un-owned stake

U.S. legalization would be a huge call option

Company announced a $50m buyback (7% of mkt cap) with Q1 results

Current Enterprise Value

What’s it Worth?

I look at value here 3 different ways: 1) Burn-down adj. book value vs mkt cap 2) Value of the balance sheet + OpCo 3) Altria takeout of their un-owned 60% stake.

Burn-down adj. book value

I look at a draconian case here where management throws up their hands and decides to wind the business down for net assets. In this case, I assign credits to balance sheet items at partial value for a number of specific accounts (ie 100% cash, 0% for inventory, 0% for goodwill), assigning 100% value to all liabilities. See the appendix for my line-by line % credits. I end up with an Adj. Assets - Liabilities of $855m, and an Adj. Book value of $807m after deducting NCI. Based on 5/5/2025 shares, that results in an Adj. BV / sh of $2.09 against a current share price of $1.87—good for a 10% discount to absolute burn-down, wind-up value.

Value of the balance sheet + OpCo

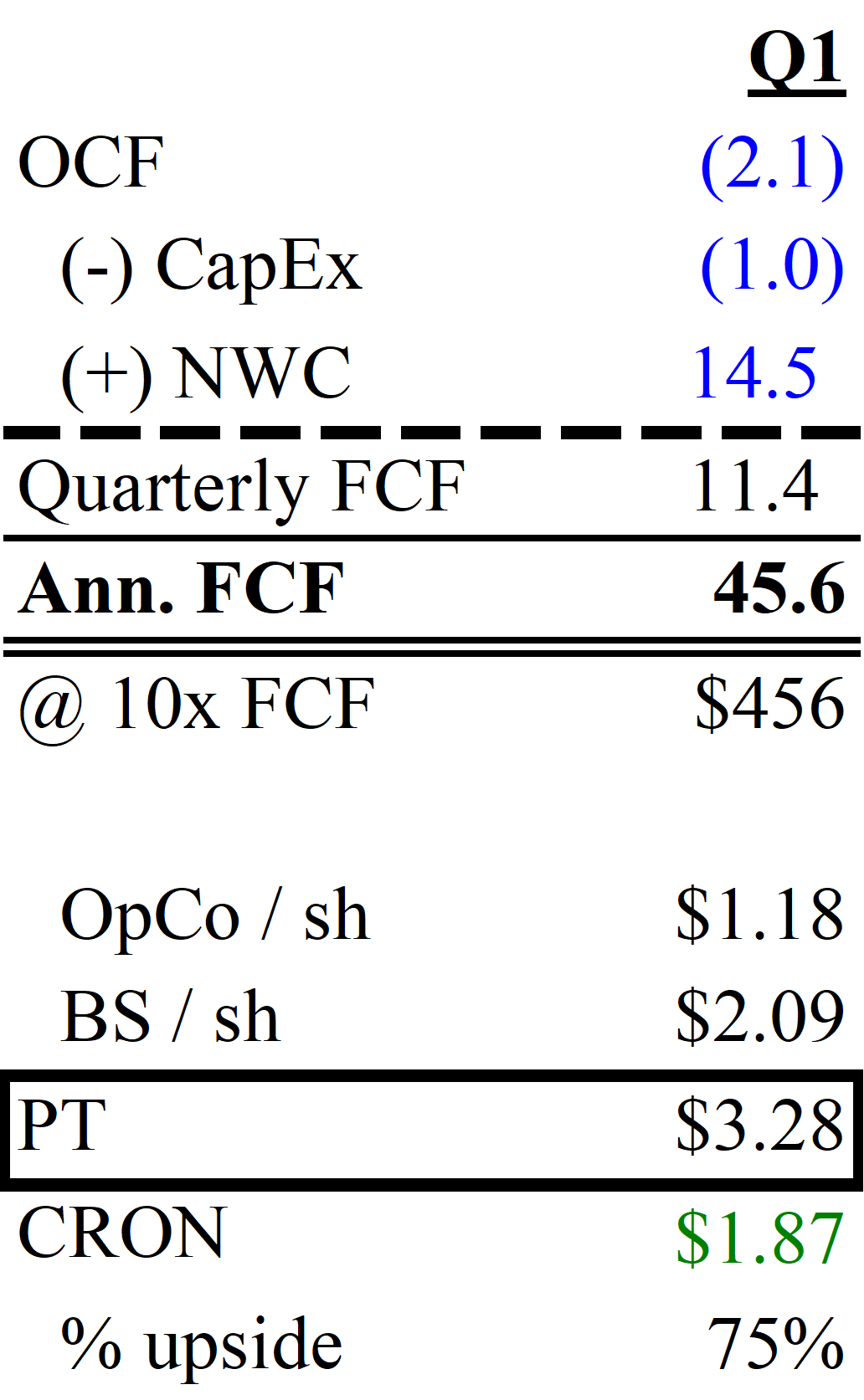

Now that I established a value for the balance sheet, the OpCo is worth something…right? In Q1, the company generated $11.4m of FCF if you add-back NWC outflow and use a normalized CapEx figure—I use an annualized $4m vs $2.5m in ‘23 and $3.5m in ‘22. On an annual basis, this is $45.6m of FCF power, which at a 10x FCF multiple (this isn’t the highest quality business after all) is worth $1.18 / share. Adding in the $2.09 of balance sheet value, my base-case price target is $3.28 / share or 75% above current levels.

Altria take-out

Altria, which owns 156.6m shares or ~40% of outstanding, could very reasonably pay a >100% premium at 10x Q1 ‘25 annualized EBITDA to acquire the remaining 60% of the business. Investors I have spoken with think the business can generate $50m of EBITDA in ‘26 (consensus is $33m). At $40m of EBITDA in ‘26, Altria would be paying just 2.3x EV / EBITDA for the remaining 60% of the business at a takeout price of $3.86. There is a multi-bagger potential if Altria pays 12x ‘26 EBITDA of $40m (~200% premium to current). I have no reason to believe Altria is currently contemplating a takeout, but the acquisition logic makes sense if they are looking to further diversify away from cigarettes and CRON is brutally cheap.

Why is this a compelling net-net?

Dissimilar from other net-nets, which are usually busted biotechs or companies with significant litigation liabilities, CRON is growing, profitable, and executing on a turnaround + buyback. The cannabis market is in a multi-year bear market and investors have largely left the story due to value destruction and poor performance. As such, I view this as a highly compelling orphaned security with extremely capped downside.

Appendix

CRON Q1 2025 Balance sheet with assigned credits by line item = $807m of Adj. BVPS.