AI Picks and Shovels Play at 6x EPS

A high-growth datacenter power play at 6x P/E with >100% upside

Summary

PSIX’s power business is growing >60%, gross margins are highly accretive, and the business is poised to grow FCF at a 32% CAGR through 2026

The company has 1 sell-side analyst, just recently uplisted to the NASDAQ, and is rapidly paying down debt related to a major shareholder

There is >100% upside at a very reasonable 10x 2026 EPS

Power Solutions International (PSIX US) | Mkt Cap: $605m | ADTV: $10m

***I felt that this is a very opportune time to post on PSIX as the CoreWeave IPO has spooked all of the names in the datacenter space. Bargain hunting and being greedy when others are fearful tends to work over time!***

Business Overview

Power Solutions International is a manufacturer of engines, power systems, and genset enclosures. PSIX is a listed, wholly-owned (51% ownership) subsidiary of Weichai Power Co., a car parts and power systems conglomerate in China. The company is currently pivoting to focus its manufacturing capacity on high growth and high margin end markets, specifically backup power generators for datacenters. Further, the company is using free cash flow to optimize its capital structure and paydown debt.

The “Power Systems” business focuses on natural gas and diesel engines, for which I approximate they are generating high 30% to 40% gross margins. These are electric power generators for emergency standby and prime power applications. The applications for AI-related datacenters are obvious: these datacenters need 99.999% uptime and need massive amounts of power, stressing local power grids. In Q4 2024, segment growth accelerated to 62% y/y; 2024 total segment growth was 45%. This business has grown from 49% of sales in ‘23 to 68% in ‘24. As datacenter providers gameplan peak power needs and disaster planning (read hurricanes, earthquakes, etc.), PSIX is uniquely positioned as a backup power insurance policy. The company is confident in forward demand and broke ground (~7mo ago) on a 100k s.f. addition to their Darien, WI manufacturing and fabrication plant. I’ll quote directly from the 10-K, emphasis my own:

“The Company is strategically prioritizing the rapidly expanding data center sector, improving and increasing our manufacturing capacity and capabilities to meet our customers’ evolving demands for our products.”

Recent introduction of several natural gas and diesel engines should provide for an ample product lineup to continue to support data center buildouts. With the datacenter buildout trend in full swing (need look no further than Sam Altman’s comments this week that “our GPUs are melting” in response to image generation success) PSIX is a very low-multiple and value way to play the massive power needs of AI.

For reference and to highlight current hyperscaler growth expectations, I’ve included a hyperscaler market model based on sell-side CapEx growth expectations. After a blistering 54% CapEx growth in ‘24, hyperscalers are primed for another year of >40% expenditure increases in ‘25 before growth tapers off to the mid single digits in ‘26. Commentary around the pace of declines / trading the second derivative of datacenter growth seems to be what moves the entire AI power space; however, broad-strokes are that datacenter demand is not letting up and in 2 years the datacenter market will need more power, cooling, and backup generators to prevent significant downtime for longer inference reasoning tasks.

The other ~25% of Power Solutions’ business is related to industrial, oil and gas, and transportation end markets. The company has significantly pivoted away from these markets (which I estimate have ~7% gross margins) with an expectation that in 2025 “sales in the industrial and transportation end markets are projected to remain about flat” (10-K). Perhaps most importantly, management has been strategically focusing away from these areas which are lower profitability and lower-return product lines; so much so that these two segments declined by 36% in 2024, masking the power segment’s 45% growth. I won’t spend much more time on these end markets but would posit that management views them as harvest businesses and not a “go-get” end market for which they will spend gross profit dollars.

Catalysts

Completed Catalysts

Refinanced their credit agreement (was at 8.7% rate) and part of Weichai’s Shareholder Loan Agreement with an RCF (6.5% rate) in August, 2024

Up-listed on NASDAQ on December 27, 2024

Paid down ~$25m of debt in ‘24 and added ~$30m of cash to the balance sheet

Paid down $10m of the Weichai SLA in February, 2025 ($15m outstanding)

Debt paydown & FCF

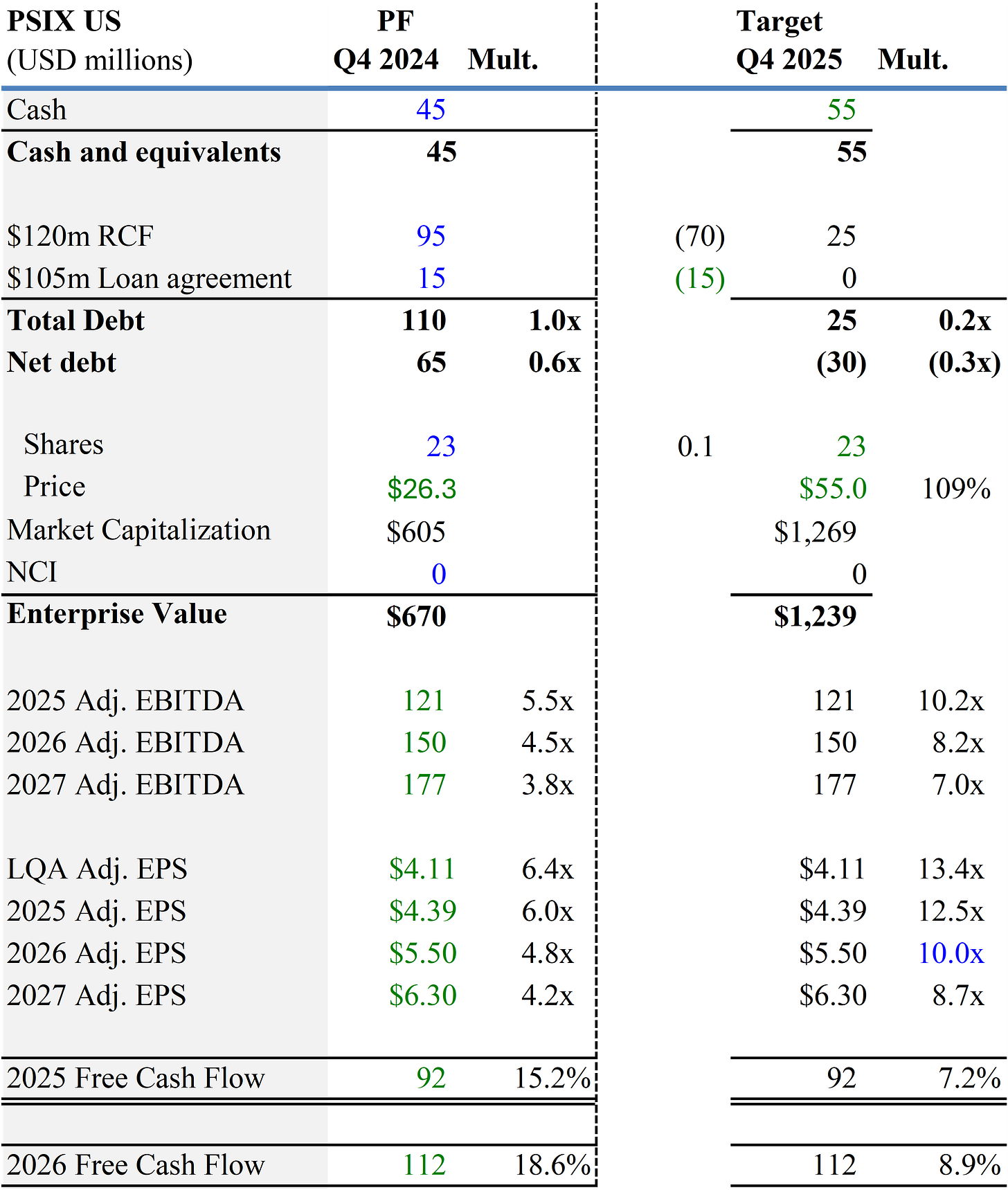

I project that PSIX will generate ~$90m of FCF in 2025 vs current net debt of $65m / total pro forma debt of $110m. Their debt instruments consist of $95m of a revolver at S+200 and an SLA with Weichai of now just $15m. These debt instruments have a maturity date of August 30 and August 31, 2025, at which point PSIX should be have substantially reduced debt and be able to refinance or extend their RCF with net debt / EBITDA of ~0.25x in August, 2025. After which, I would not be surprised if the company pursues a share buyback or dividend (a 50% payout ratio in 2026 results in a dividend yield of 10%) in ‘26.

Transition to a growth business

On the surface, PSIX screens as a 4% growth business with 30% gross margins and 17% EBITDA margins in an ok but not extremely moaty industrial sector. However, under the hood the power segment, which is growing >60%, should take overall growth to ~25% in 2025. The simple napkin math being 75% of the business is growing 40% (could prove conservative) and 25% of the business is declining by 5% (my expects, although management said it would be ~flat in ‘25). Thus, PSIX will go from screening as a 4% growth industrial business to a >20% growth AI datacenter power play. Further to this point, historical financials signal that when the power segment was 27% of revenue (in ‘21) gross margins were just 9%; fast-forward to ‘24 and 68% power revenue mix resulted in 30% gross margins. My approximations (gross margins by segment are not disclosed) are that the power business is ~40% gross margin, which foots with management saying that they are pursing higher margin revenue sources. Expanding into higher growth and more attractive margin end markets could effectuate a substantial multiple re-rate and help PSIX as screen better to institutional buyers.

Projections, Valuation, Price Target

Projections

My summary model projections below highlight the business’ growth potential over the next few years. The business is undergoing a significant transformation with power going from 37% of revenue to >80% in a 5-year timeframe. This should help push EBITDA margins to ~25% by 2027.

Valuation

As far as current valuation, the equity is trading at a very attractive 6.0x ‘25 P/E and a EV / ‘25 EBITDA of 5.5x . A few (loose) peers such as AGX, SEI, CAT, and CMI trade at 15.5x, 12.0x, 9.0x, and 7.5x ‘26 P/E respectively. These businesses have less exposure to high-growth datacenter and engine end markets (e.g. CMI’s engine segment is 28% of sales, SEI’s power division is ~35% of sales). I find this to be a very interesting entry point and there is additional upside to my numbers if the power center segment outperforms.

Price Target

I use a blend of absolute and relative valuation for my price target of $55 ($5.50 of ‘26 EPS * 10x). Industrial peers with less datacenter exposure such as CMI and CAT trade at an average of 8.3x ‘26 P/E. A similar energy-agnostic high-growth power industry business like Argan (AGX), which is growing >50%, trades above 15x ‘26 P/E. SEI (12x ‘26 P/E) might be the best peer as it has a natural gas-powered mobile turbines business, but growth and margins there are slightly better than at PSIX. As I expect PSIX to grow ~25% in ‘25, somewhere in between 8.5x and 15x ‘26 P/E seems fair. Due to the inherent risks of investing in a Chinese-adjacent business, I also feel that a 10x P/E multiple is fair from an absolute valuation perspective. Thus, I use a 10x multiple in my valuation analysis directly below & include a sensitivity on price target and upside from 8x-15x exit multiples.

Altogether, I view PSIX as a bargain way to play the growing datacenter power space. There are a few soft catalysts that should help effectuate a re-rate, but above all execution and firming up investor expectations around end market durability should cause the share price to increase substantially over the next 2 years.

Risks

Weichai (a 51% owner of PSIX) could pursue something nefarious like a take-under or buyout at an unfair price, then minority shareholders could be hurt

Hyperscalers pull significant datacenter spend and PSIX power segment does not grow similar to expectations

Tariffs significantly derail the PSIX supply chain and they are unable to pass price through to customers

Debt refinancing does not go well over the next 6mo and PSIX has to refinance at higher rates

Competitive players (like CMI and CAT) overbuild engine manufacturing capacity and floor the market with alternatives, causing PSIX prices & gross margins to fall

There is some GPU or technological advance that I (and semiconductor analysts) am totally unaware of resulting in power usage that is fraction of current GPUs